What Does Medicare Cost?

Medicare Part A

Covers inpatient hospitals, skilled nursing facilities, hospice, inpatient rehabilitation, and some home health care services. Thankfully, most Medicare beneficiaries do not have a Part A premium since they have 40 or more quarters of employment. Forty Quarters is the equivalent to ten years. For a stay in a skilled nursing facility, individuals will pay $209.50 per day for days 21 through 100. This extended care service was $204 per day for 2024.

Medicare Part B

Covers services such as doctors’ office visits, outpatient hospital care , and durable medical equipment. Unfortunately, Medicare Part B has a monthly premium. Premiums, deductible, and the coinsurance rates are determined according to the Social Security Act. The standard monthly premium for Medicare Part B will be $185 for 2025. This is up $10.30 from the $174.70 in 2024. The annual deductible for Medicare Part B will be $257 in 2025. Deductible amount for 2024 was set at $240.

What is IRMAA?

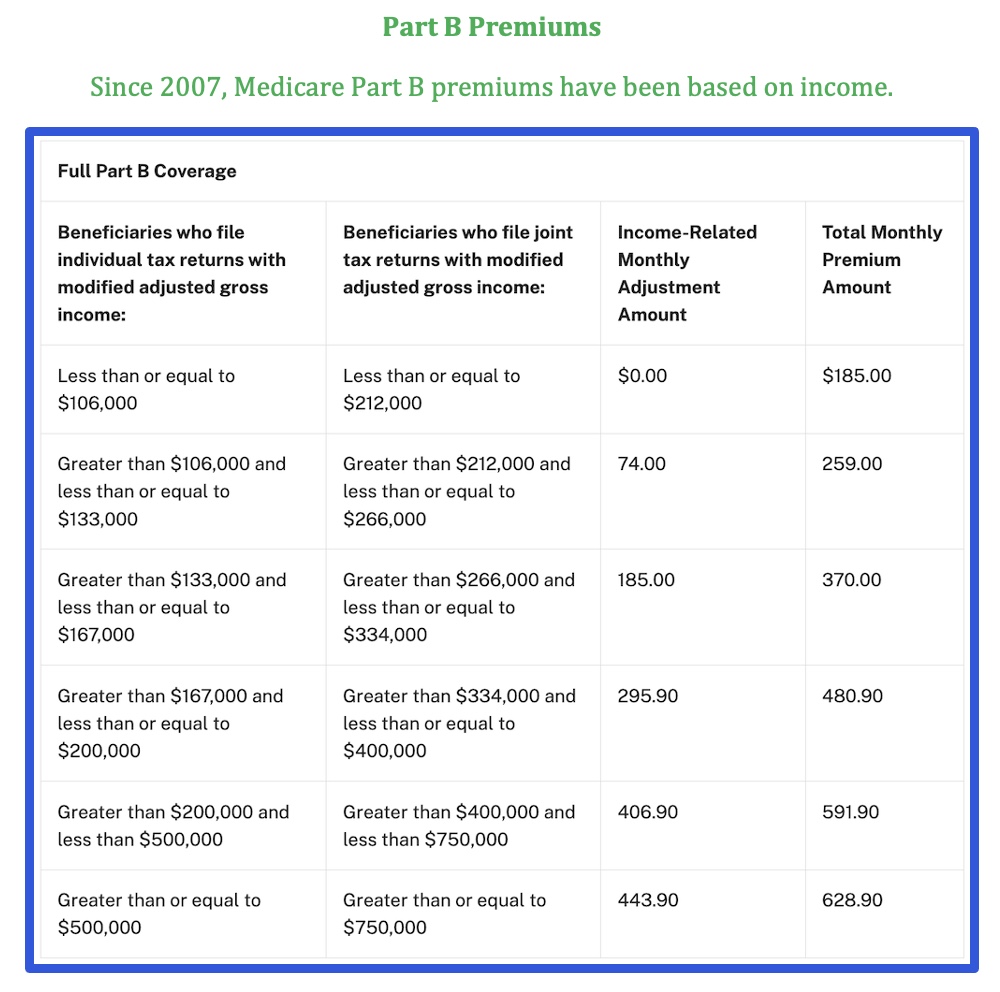

Income Related Monthly Adjustment Amount (IRMAA) is an additional premium that people with income above a certain amount must pay on top of the standard Medicare Part B and Part D premiums. Determination of IRMAA is done yearly and is based on the income you reported on your tax return two years prior.

The Social Security Administration determines IRMAA based on your tax return. The income that counts is your adjusted gross income that is reported plus other forms of tax-exempt income. Your IRMAA for 2025 is based on your 2023 tax returns, while 2024 IRMAA was based on year 2022.

If your income is higher or lower from year to year, your IRMAA status may change. You will receive a letter if you must pay IRMAA. The letter will inform you of your increased premium amount and the income based on the decision. The chart below outlines 2025 Part B Premiums. Simply find the column that has your 2023 tax return amount to calculate your premiums.

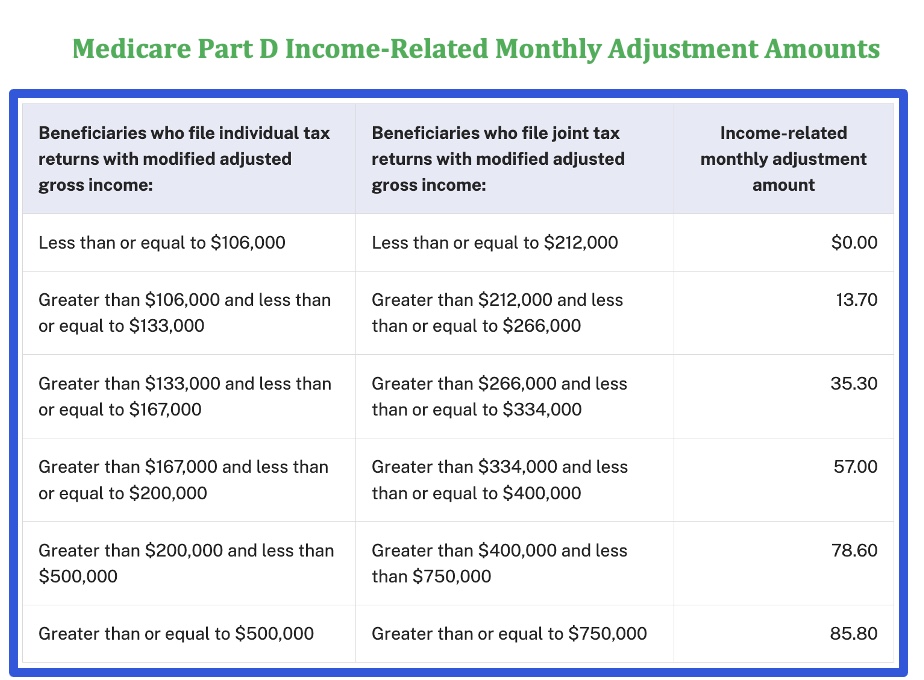

Prescription plans pricing vary. A person would add the appropriate IRMAA amount to the

monthly cost of their prescription plan.