Medicare Deductible and Medicare Costs in 2023

- Inpatient Hospital Stay – You Pay….. (benefit period ends 60 days after release from care)

-

- Medicare Deductible: $1,600 per benefit period

- Coinsurance (days 1-60): $0 per day of each benefit period

- Coinsurance (days 61-90): $400 per day of each benefit period

- Coinsurance (60 lifetime reserve days): $800 per day after day 90 of each benefit period

- Skilled Nursing Facility Stay – You Pay….. (3-day inpatient hospital stay required first)

-

- Coinsurance (days 1-20): $0 per day of each benefit period

- Coinsurance (days 21-100): $200 per day of each benefit period

- You will pay a $226 deductible before Original Medicare starts to pay. This deductible is once each year.

- Generally, your cost (coinsurance) will be 20% after the $226 Medicare deductible is met.

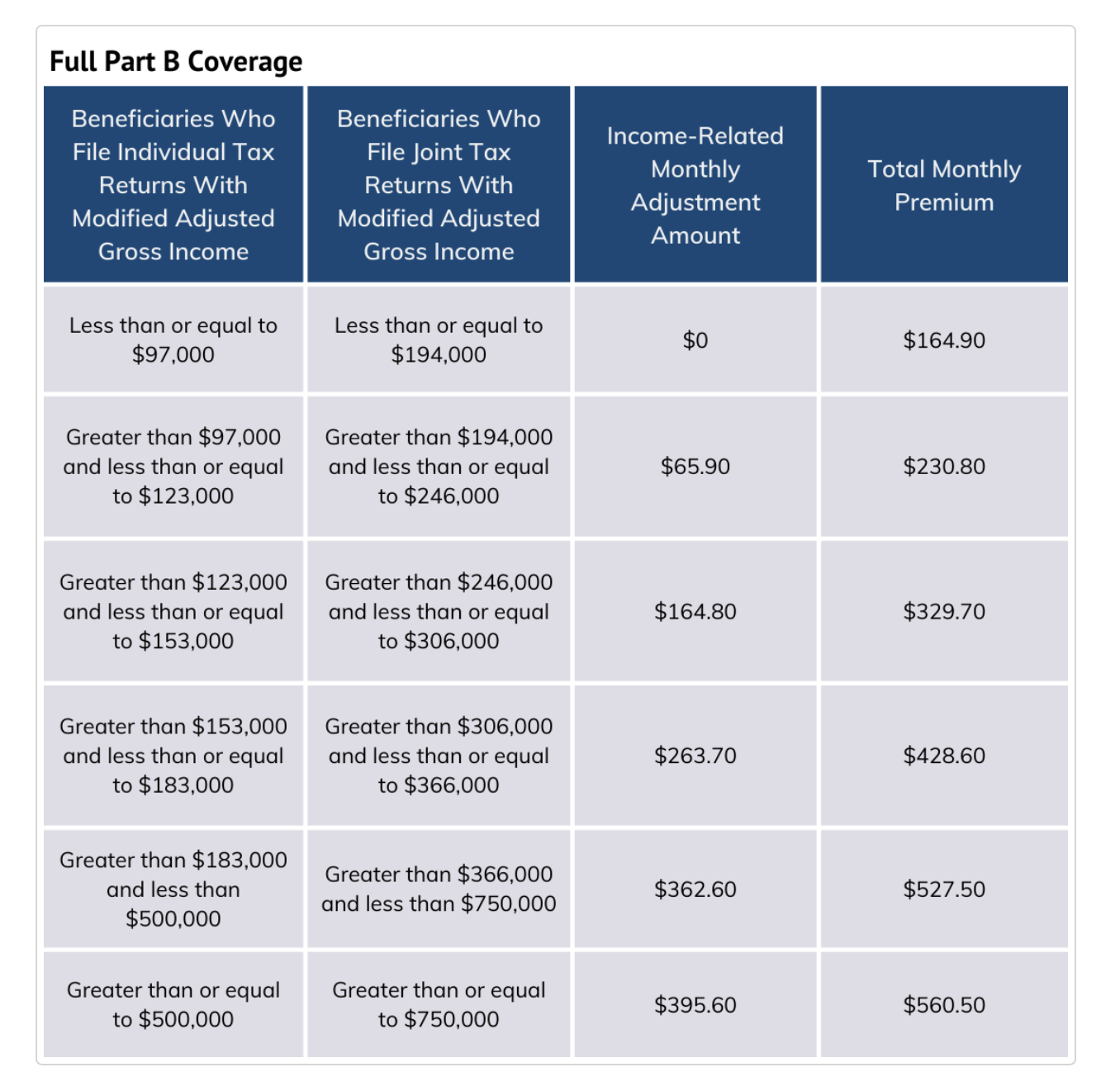

- Those enrolled in Medicare Part B will pay the premiums listed in the table below (based on income).

- Higher income earners will pay Part B IRMAA (Income Related Monthly Adjustment Amount).

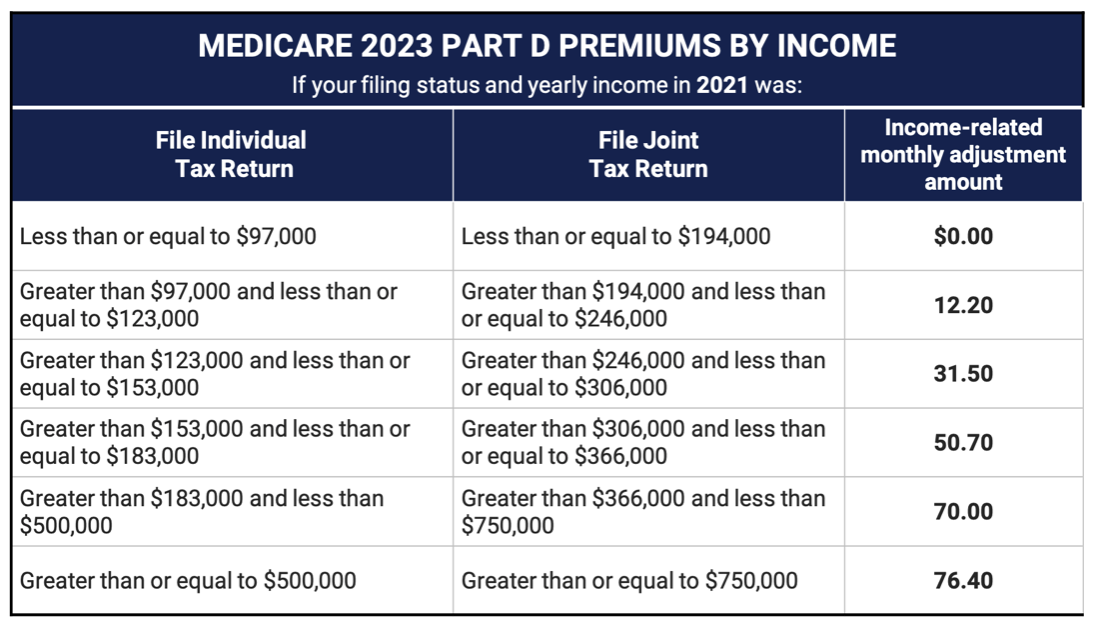

- Higher income earners enrolled in Part D (Prescription Drug coverage) also pay a Part D IRMAA.

- Your Medicare Part B premiums are based on your tax return from 2 years prior.

If you have any questions concerning your current coverage, please give us a call at 1-877-756-9005. Also, be sure to check the supplements overview page: Medicare Supplements, or if you prefer to view a holistic side-by-side Medigap plan overview head over to Medicare site by clicking HERE!