New to Medicare

Several months prior to your 65th birthday, something happens. You start receiving mail and phone calls like never before. Every phone call and letter you receive in the mail is about Medicare. You will also receive a book in the mail entitled Medicare and You Handbook. This book has information and terms that may be difficult to understand.

Suddenly, turning 65 and starting Medicare can feel a bit overwhelming. You have probably worked many years and haven’t had to put much thought into your healthcare coverage, because your coverage was through your employer.

Now it is all up to you. Which option do you choose? Do you need Medicare if you will continue to work? These are just a couple of questions that could come into play when you are making your decision about coverage.

You are not alone if you feel lost or confused. There are many questions surrounding Medicare. In fact, there are so many questions that you can even purchase a book entitled Medicare for Dummies.

Medicare Eligibility!

Generally speaking, Medicare is available for people age 65 and older. Someone younger than age 65 with certain disabilities and people with End Stage Renal Disease also qualify for Medicare. Medicare has two parts – Part A (Hospital Coverage) and Part B (Outpatient Coverage). You are eligible for Medicare on the first day of the month in which you turn 65 (or earlier if you have qualified for Medicare due to disability).

Medicare Part A covers inpatient care, hospital stays, skilled nursing facility care, hospice care, and medically needed home health care services. Part B of Medicare covers medical services such as doctor visits, lab tests, diagnostic screenings, medical equipment, ambulance transportation and other outpatient services.

Medicare Part A and Medicare Part B are provided to you through the federal government. Medicare Part A and Medicare Part B are also known as original Medicare. The Social Security office will assist you with signing up for Medicare. Click the following link to locate your nearest Social Security office. Local Social Security Office Finder.

Medicare Coverage Options

Original Medicare OR Medicare Advantage

Basically, you will have TWO options for your coverage – Keep Original Medicare/Medicare Supplement OR select a Medicare Advantage plan. You can not have both. If you have a Medicare Advantage plan, your benefits come from a private company instead of Original Medicare. Medicare Advantage plans are sometimes called “replacement plans”.

Original Medicare alone can leave you with large medical bills. Supplemental insurance will provide you with little to no out of pocket costs for your medical care. Medicare Supplement plans are sold by private companies and bridge the gaps found in Original Medicare. A Medicare Supplement plan is sometimes referred to as a Medigap plan.

Medicare Supplements (also called Medigap Plans)

Medicare Supplements – Supplemental (Medigap) plans pay after Original Medicare (Medicare Part A and Medicare Part B) has paid. A supplemental plan will cover the 20% left after Medicare pays. Original Medicare with supplemental coverage provides you freedom of choice. You can see ANY healthcare provider that participates in Medicare. You can cross state lines or go across the country for your medical care if you so choose.

Medicare Advantage Plans (Part C)

Medicare Advantage plans are also called Part C plans. Part C plans (Medicare Advantage) will pay for your medical care instead of Original Medicare. Premiums usually cost less than Medicare Supplement plans. Advantage plans are offered by private insurance companies and are generally an HMO or PPO type plan. Medicare Part C plans will offer additional benefits such as dental and vision coverage.

With Advantage plans, you most likely be required to use medical providers in the established networks to get the lowest copays. You will be responsible for co-pays for most medical services. The plan coverage and out of pocket costs vary from area to area. The key is to make sure that your medical providers are in network with the plan you choose.

Generally speaking, Medicare Advantage plans have lower monthly premiums than Medicare Supplemental plans. Medicare Advantage plans place you in a network. You are not in a network with Original Medicare and supplemental coverage. It is important to base your decision on what is the best option for you and your medical care.

Medicare Part D

Medicare Part D is your prescription drug coverage plan. It is commonly called “your drug plan.” Most states offer over 20 options for Medicare Part D. Each plan comes with a monthly premium. Premiums can range from approximately $15 – $80 per month.

So, how do you decide which Part D option to choose? You want to select the drug plan that covers your combination of prescriptions at the lowest out of pocket cost to you. Each drug plan has a formulary of medications that are covered with their plan. Formularies vary from plan to plan. Plans are also pharmacy specific.

When you present your Medicare Part D card to your pharmacy, they are going to consider your plan as Preferred, Standard, or Out of Network. “Preferred” means you are getting your prescriptions filled at the lowest and best possible price. “Standard” means you are paying a little more for your prescriptions. “Out of Network” could mean an extreme cost to you for your medications. Medicare has a great tool to assist in your plan selection.

Medicare Costs

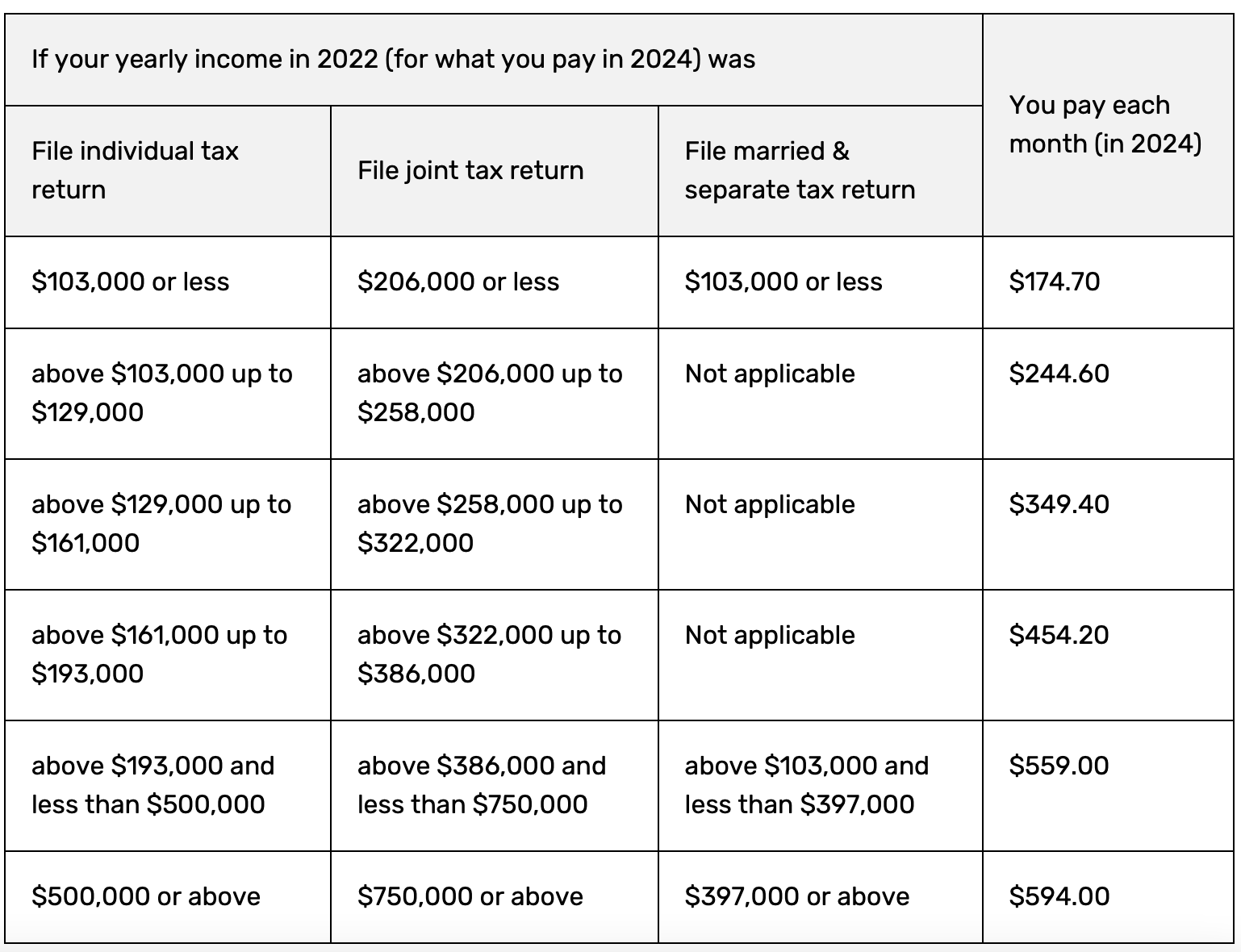

Most individuals receiving Medicare benefits will not pay a premium for Medicare Part A. However, there is a premium for Medicare Part B. Your Part B premium cost is based on your income from 2 years prior.

Most individuals pay $174.70 monthly for Medicare Part B. In general, if you elect to enroll in a Medicare Advantage plan, you will still pay the Medicare Part B premium. Your cost for Medicare Part B can change from year to year because it is always based on your tax return from two years prior.

Medicare Part B Premiums

Do I Need Medicare If I Continue Working?

As stated above, Medicare Part A is free for almost everyone. It is free if you or your spouse have worked 10 years or more. The cost of Medicare Part B will depend on your income. Because Medicare Part B has a monthly cost, you may ask yourself, “Do I need Medicare Part B?”

You may not need Medicare Part B if you will continue to work once your turn age 65. If your employer has 20 or more employees, your group coverage will continue to be your primary insurance. Medicare will be your secondary insurance. You may need to consider delaying Part B, because your group insurance provides you with outpatient benefits.

Compare Your Costs and Benefits

Medicare Part A is free, but Medicare Part B has a monthly premium. Currently most individuals pay $174.70 monthly for their Part B premium. Multiple your monthly premium for Medicare Part B to total your yearly costs. Annually you would be paying almost $2,100 for your Medicare Part B premiums. Medicare Part B would need to pay out over $2,100 in medical claims for you to benefit financially.

If you delayed Medicare Part B while you were still working, you would keep the $2,100. Once you retire, then you could complete the process to sign up for Medicare Part B. You will not be penalized for choosing this option, because your employer is providing you with creditable coverage. However, there is a limited time frame to enroll in Medicare Part B after ending group coverage.

You will have an 8 month period to sign up for Medicare Part B that starts at one of these times (whichever happens first): the month after your employment ends or the month after your group health plan ends

Example

Charles is turning 65 and will continue to work. He is employed by a large company that provides him with group insurance coverage. Charles can delay his Medicare Part B because of the group coverage. Charles will not receive any penalty for choosing this option, because his employer is providing him with creditable coverage.

Medicare has two parts, Medicare Part A and Medicare Part B. As long as Charles is working and has group coverage through his employer, he could start Medicare Part A and delay Medicare Part B. Why start Medicare Part A? Medicare Part A is free. When Charles makes the decision to retire, he would then enroll in Medicare Part B.

What About All This Mail and Phone Calls?

Your mail is more than likely increasing as you approach your Medicare start date. You are also probably wondering how all these Medicare callers got your phone number.

Most of the mail you receive is from companies trying to earn your business. REMEMBER this – Medicare will NEVER call you to assist you with enrollment in products or ask you questions about your Medicare.

If you receive an unsolicited call, do not give out your personal information. Also, Medicare will NOT mail you a letter or postcard asking you to call them about new benefits or programs. Most letters and postcards are from private companies trying to get your information or sale you some type of insurance.

It is important to open and keep mail you receive from the Centers for Medicare and Medicaid (CMS) and/or Social Security. The key to your Medicare coverage is to find someone you trust to assist you.

Conclusion

This brief article is just an overview of Medicare. Generally speaking, you will have two options for your coverage, Original Medicare (Part A and Part B) OR Medicare Advantage (Part C).

There are many questions and scenarios that you may be thinking of right now that are not covered in this article. The key is to ask questions and make sure you fully understand your coverage options as you transition into Medicare.

Our family owned business has been helping individuals just like you for many years. We will guide you through the process and be here to answer any questions. Best of all, our services are free to you.

Belmont Office 662-454-9800 Tupelo Office 662-269-8833

Toll Free – 1-877-756-9005