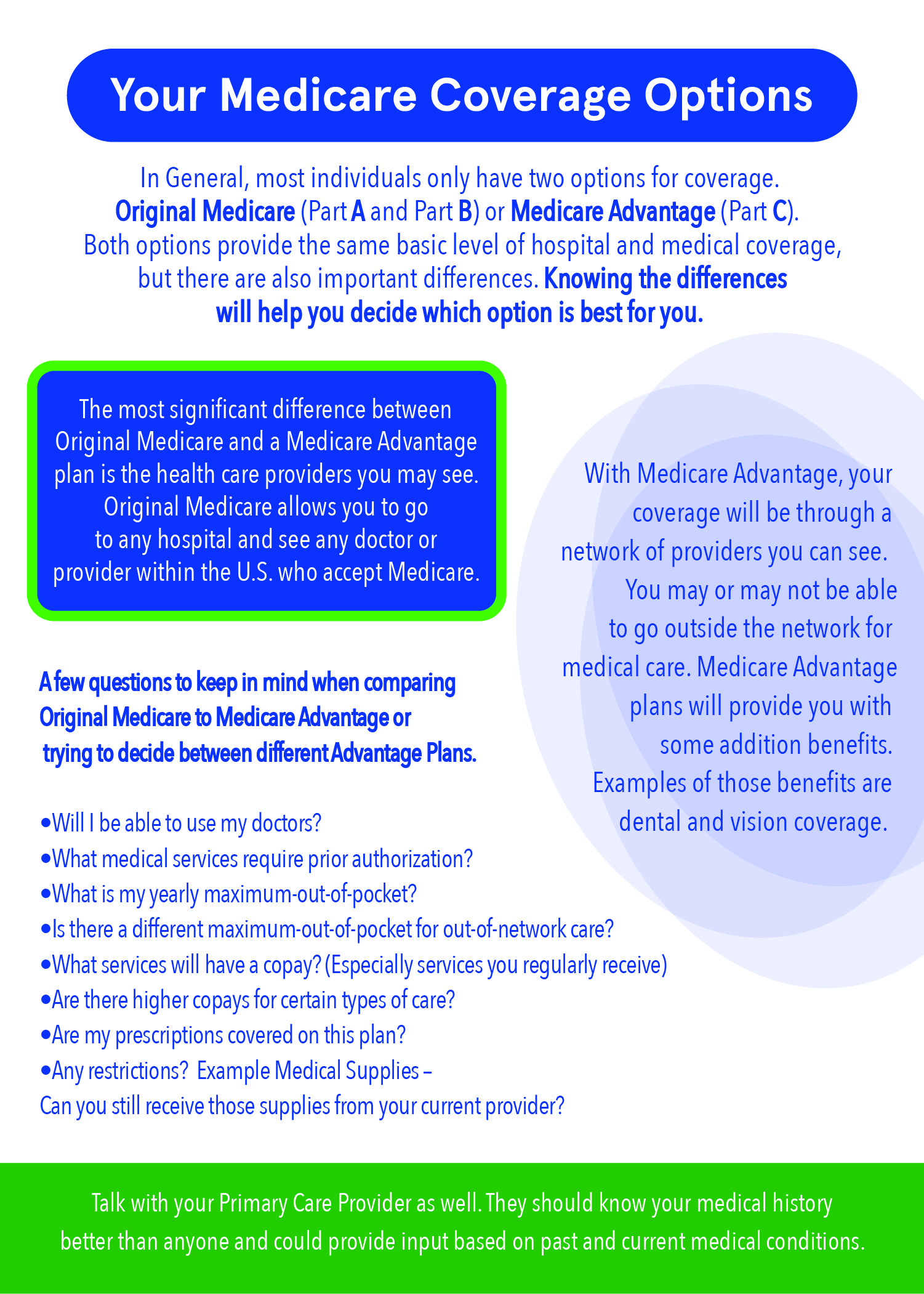

Original Medicare & Medicare Advantage

Comparing Your Two Coverage Options

Original Medicare (Medicare Part A & Medicare Part B) and Medicare Advantage (Part C) are two different ways to receive your Medicare benefits/coverage. Both options provide you with hospital and medical insurance, but there are differences between them.

Learning about the differences in your coverage options will allow you to make an informed decision when selecting which option is best for you.

Comparing Your Two Options

-

Medical Providers/Care

With Original Medicare, you can see any doctor or specialist that accepts Medicare, without the need for a referral.

Most Medicare Advantage plans have a provider network, which may restrict your choice of healthcare providers. You will also have medical services that will require prior authorization from the Advantage Plan.

-

Maximum Out-of-Pocket Costs

Original Medicare has no out-of-pocket maximum unless you purchase a supplemental policy. The supplemental policy (Medigap) will be secondary to Original Medicare and will limit your out of pockets to almost zero yearly.

Medicare Advantage plans have annual out-of-pocket limits. This means that once you reach the limit, a Medicare Advantage plan will cover 100% of your Medicare-approved expenses for the remainder of the year. In 2024 the Out-of-Pocket Limits will depend on the Medicare Advantage Network. Those will range from about $5,000 up to $11,500.

-

Part D Prescription Drug Coverage

Original Medicare does not include prescription drug coverage—you would need to purchase a separate Part D prescription drug plan. The plan that you select would depend on your combination of prescriptions and pharmacy you use.

Most Medicare Advantage plans include drug coverage. You would want to make sure that the Advantage Plan covers your prescription medication.

-

Additional Benefits

Most Medicare Advantage plans include extras such as dental, vision, fitness, hearing, and telehealth benefits.

Original Medicare does not cover these costs. A separate dental/vision plan would need to be purchased if that was an important benefit to you.

-

Travel Considerations

Since Original Medicare doesn’t have a provider network, your coverage travels with you. Your Original Medicare benefits are good nationwide.

Medicare Advantage coverage is limited to the plan’s service area, which means your plan may not cover you while traveling (except for emergency care).

-

Medigap and Indemnity Plans

Medigap is available to Original Medicare beneficiaries only and is designed to supplement that coverage, for an extra premium.

You can’t purchase a Medigap (Medicare Supplement) policy if you are receiving your benefits through a Medicare Advantage plan.

You can purchase products to help with out-of-pocket expenses in your Medicare Advantage. Indemnity plans can be customized to guard against possible medical costs associated with an advantage plan.

Your Medicare Coverage is very important.

Ask questions if you don’t fully understand your options.