Medicare Supplements

Original Medicare is intended to help cover your healthcare costs. Unfortunately, Original Medicare (Medicare Part A and Medicare Part B) does not pay 100% of your costs for medical care. You will be financially responsible for copays, coinsurance, and deductibles. After Medicare pays, your cost will usually be 20% for medical services you receive.

Medicare supplement insurance, sometimes referred to as a Medigap plan, is an additional insurance policy you can purchase to help pay out-of-pocket costs that would normally be your responsibility.

Original Medicare and Medicare Supplemental Coverage

Original Medicare is your primary insurance, and your Medicare supplement is considered your secondary insurance. Original Medicare will pay the approved amount for your services and then the Medicare supplement will pay its share.

The combination of Original Medicare and a Medicare supplement will limit your out-of-pocket expenses for medical care and provides you with a “peace of mind” about your financial costs for health care in the event of an accident or illness.

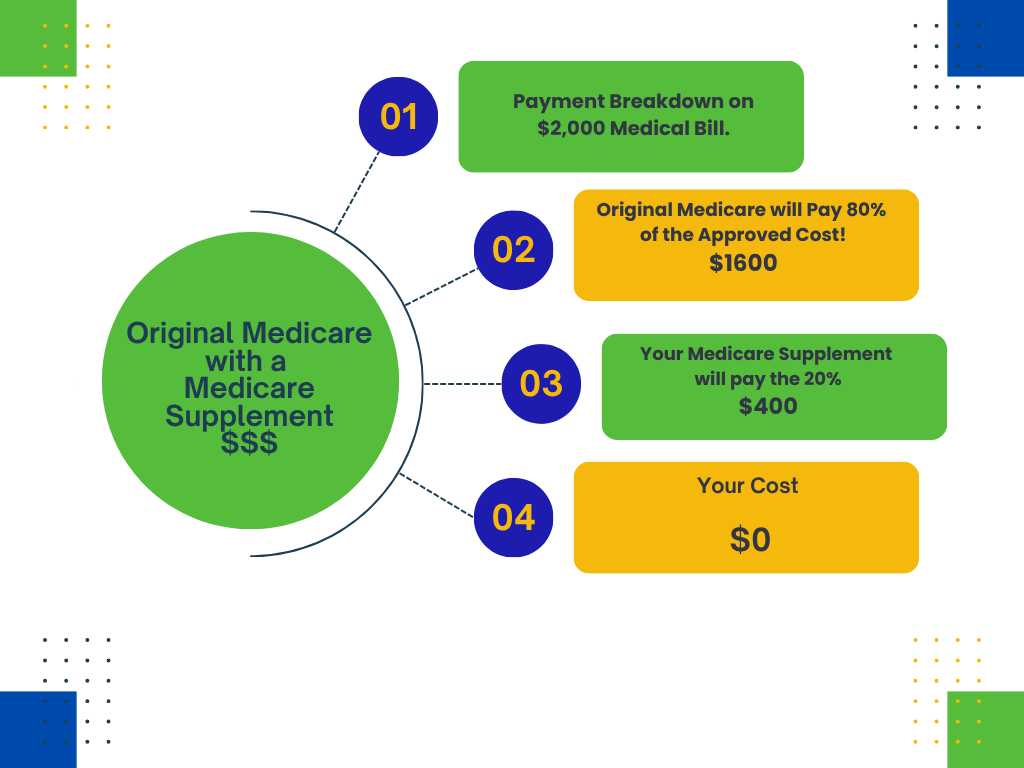

Provided that you have met your Part B* deductible, the following is an example of how Original Medicare and a Medicare Supplement plan would pay on a medical bill for services that totaled $2,000.

Part B* – Currently the Part B deductible is $283

Standardized Plans

Supplemental plans are standardized and are required by law to follow federal and state guidelines. Medicare supplement plans are referred to or named by letters. Letters used to identify plans are letters A through D, F, G, and also K through N. Two of the most common plans are Medicare Supplement Plan G and Medicare Supplement Plan N.

Plans with the same letter must offer the same benefits. Coverage is the same and it does not matter where you live or the insurance company you have your coverage through. Price is the only difference between policies with the same letter.

Example

Alice lives in Georgia and has Original Medicare as her primary insurance, and she has a Medicare Supplement Plan G through Aetna. Alice’s sister, JoAnn, lives in Michigan and also has Original Medicare as her primary insurance. JoAnn has a Medicare Supplement Plan G through Mutual of Omaha.

Even though one has coverage through Aetna and the other has coverage through Mutual of Omaha, their coverage is the same. Medicare Supplement Plan “G” coverage is the same NO MATTER what company it is offered through.

The ONLY thing that may be different could be price. Each insurance company decides how they will determine the price (usually a monthly premium) for its Medicare supplemental (Medigap) policies. Alice and JoAnn could be paying different premiums for the same coverage.

Medicare Advantage and Medicare Supplements

If you have a Medicare Advantage plan for your coverage, you will not need to purchase a Medicare supplemental plan. Medicare supplement plans only work when

Original Medicare is your primary insurance. A Medicare Advantage plan replaces Original Medicare as your primary insurance.

Your Coverage

Understanding your Medicare coverage can be overwhelming. One of our goals as an agency is to help you fully understand all your options. Your healthcare and the coverage you select is very important. We will assist you in understanding your options from cost to coverage. We will guide you and answer your questions, so you can make the best decision for you and your family.