2026 Medicare Premiums and Deductibles

The costs for Medicare for year 2026 have been released. This includes the new premiums, deductibles, and coinsurance amounts for Medicare Parts A and B, along with the income-related monthly adjustment amounts (IRMAA) for Medicare Part D.

Medicare Part A Premium and Deductible (2026)

Medicare Part A helps pay for inpatient hospital care, skilled nursing facility care, hospice, inpatient rehabilitation, and certain home health services. Most people with Medicare—about 99%—do not pay a Part A premium because they have at least 40 quarters (10 years) of Medicare-covered employment, as determined by the Social Security Administration.

Inpatient Hospital Deductible

In 2026, the Part A inpatient hospital deductible will be $1,736, which is $60 more than the $1,676 deductible in 2025. This deductible applies to the beneficiary’s share of costs for the first 60 days of Medicare-covered inpatient hospital care during a benefit period.

Hospital Coinsurance

After day 60 of a hospital stay in a benefit period, beneficiaries pay daily coinsurance. In 2026, those amounts will be:

-

$434 per day for days 61–90 (up from $419 in 2025)

-

$868 per day for lifetime reserve days (up from $838 in 2025)

Skilled Nursing Facility Coinsurance

For beneficiaries in a skilled nursing facility, the daily coinsurance for days 21–100 of extended care services in a benefit period will be $217.00 in 2026, compared with $209.50 in 2025.

Medicare Part B Premium and Deductible (2026)

Medicare Part B covers doctors’ services, outpatient hospital care, certain home health services, durable medical equipment, and other medical services not covered under Medicare Part A.

In 2026, the standard monthly Part B premium will be $202.90, an increase of $17.90 from $185.00 in 2025. The annual Part B deductible will be $283 in 2026, up $26 from $257 in 2025.

The higher 2026 premium and deductible primarily reflect projected price changes and increased expected utilization, consistent with historical experience. Without actions taken during the Trump Administration to address unusually high spending on skin substitutes, the Part B premium increase would have been about $11 higher per month.

Medicare Part B Monthly Premium

Determining your Medicare Part B premium can be complicated because it’s based on your modified adjusted gross income (MAGI). Social Security typically uses your IRS tax return from two years ago to set what you’ll pay for Parts B and D (Part D is also income-based). Approximately 5% of Medicare beneficiaries pay the higher, income-adjusted premiums for Medicare Parts B and D.

MAGI generally reflects income such as wages, interest, dividends, capital gains, Social Security benefits, and distributions from tax-deferred pensions. By contrast, money from Roth IRA or Roth 401(k) distributions, life insurance proceeds, reverse mortgages, and health savings accounts (HSAs) does not count toward MAGI for this calculation.

If you filed married filing jointly, Social Security uses your combined household income to determine the premium tier (surcharge) for each spouse. Even so, each spouse pays their own Part B premium.

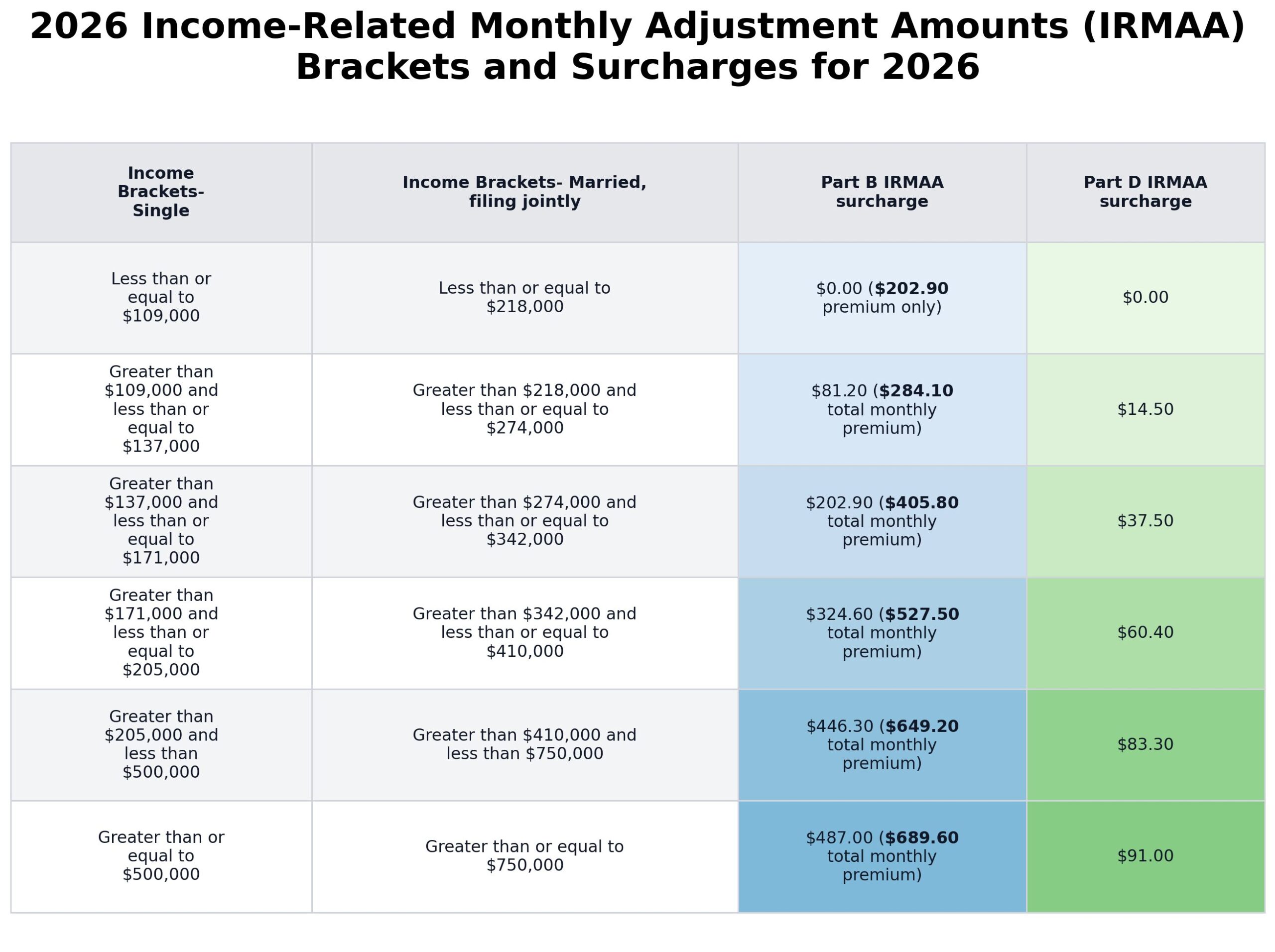

The extra charge assessed to Medicare Part B is called IRMAA (Income-Related Monthly Adjustment Amount). Social Security usually sends your premium notice each year in December or early January. This initial notice will inform you if you must pay IRMAA. Determination of IRMAA is done yearly and is based on the income from your tax return two years prior. Your monthly cost for Medicare in 2026 is based on your 2024 tax return.

Appealing IRMAA

If you’re assessed a higher premium for Part B and Part D, you may be able to appeal the decision. The initial notice letter will provide you with information on how to request the appeal. If you have experienced a life-changing event that caused an income decrease, or if you think the income Social Security used to determine your IRMAA was incorrect or outdated.

The following situations are considered life-changing events:

- The death of a spouse

- Marriage

- Divorce or annulment

- You or your spouse stopping work or reducing the number of hours you work

- Involuntary loss of income-producing property due to a natural disaster, disease, fraud, or other circumstances

- Loss of pension

- Receipt of settlement payment from a current or former employer due to the employer’s closure or bankruptcy

To request a new initial determination, submit a Medicare IRMAA Life-Changing Event form or schedule an appointment with Social Security.