Medicare Premiums

Income Related Monthly Adjustment Amount

Some individuals believe that once they begin Medicare, that it is free. Unfortunately, that is not true. Original Medicare is composed of two working parts, Medicare Part A and Medicare Part B. Medicare Part A is free for most individuals because they paid Medicare taxes while working.

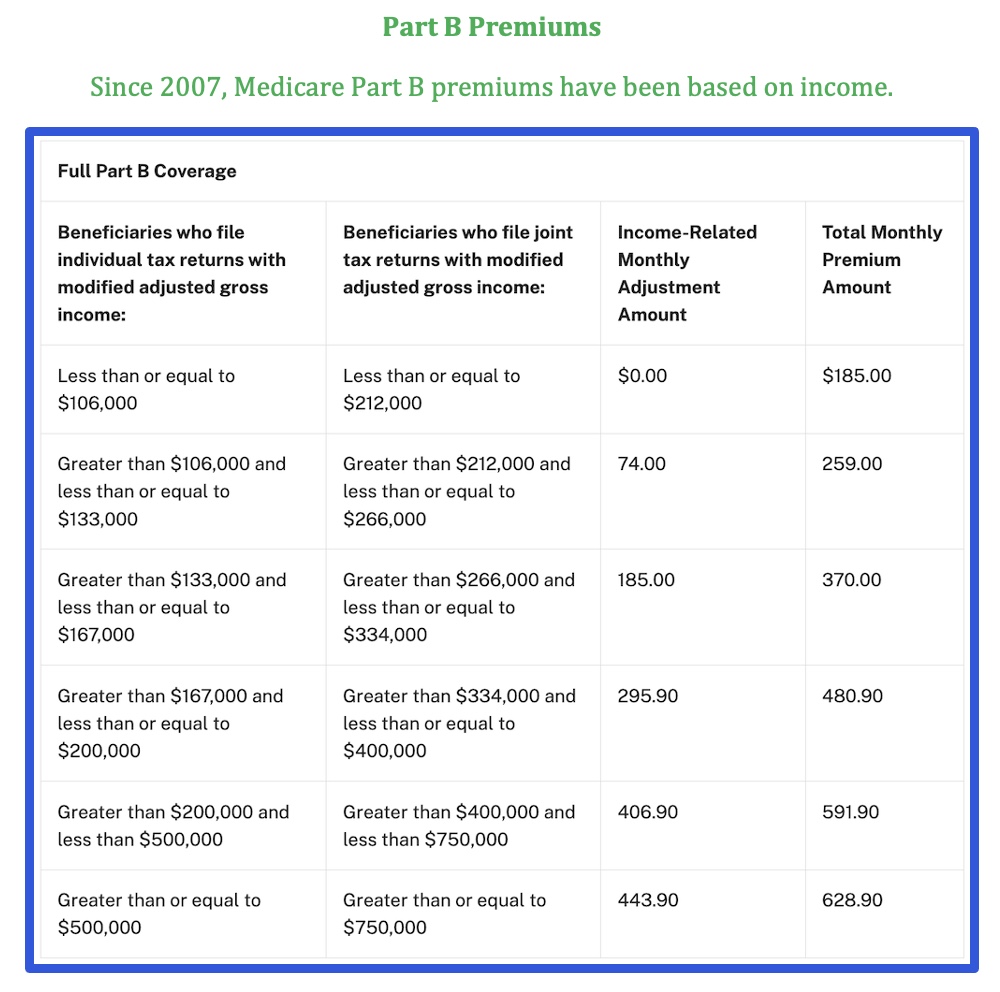

Medicare Part B is not free and does have a monthly cost. Most individuals pay the standard Part B monthly premium amount. For year 2025 the standard amount is $185. Social Security determines the exact amount that beneficiaries will pay.

IRMAA

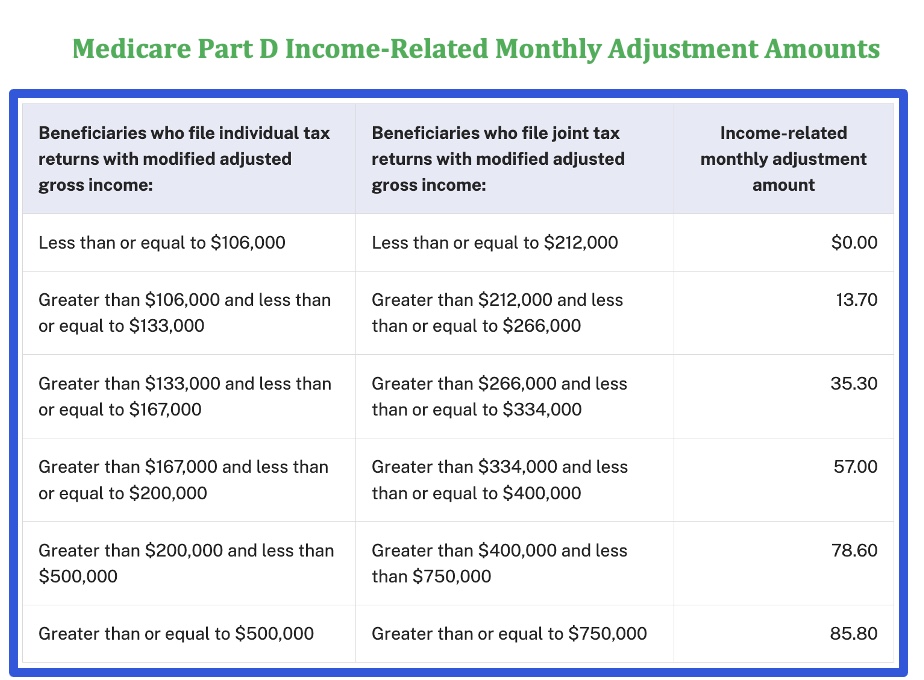

Income Related Monthly Adjustment Amount (IRMAA) is an additional premium that people with income above a certain amount must pay on top of the standard Medicare Part B and Part D premiums. Determination of IRMAA is done yearly and is based on the income you reported on your tax return two years prior.

How is the Medicare IRMAA determined?

The income that counts is your adjusted gross income that is reported, plus other forms of tax-exempt income. Your IRMAA for 2025 is based on your 2023 tax returns, while 2024 IRMAA was based on year 2022. This additional cost applies to Medicare beneficiaries who have a modified adjusted gross income over $106,000 for an individual return and $212,000 for a joint return. If your earnings are below these amounts, IRMAA will not apply to you.

If your income is higher or lower from year to year, your cost for Medicare Part B and Part D may change. You will receive a letter if you are required to pay IRMAA. The letter will inform you of your increased premium amount and the income used to make this decision.

Appealing IRMAA/Life Changing Events

You can make a request for the Social Security to revisit its decision if you have experienced certain life-changing events that caused your income to decrease. You may also make this request if you believe the income information used to determine your IRMAA was incorrect. The letter you receive will include information on how you may request a review.

Social Security considers any of the following situations to be life-changing events:

- Marriage, Divorce, or Annulment of a Marriage

- You or your spouse stop working or reducing the number of hours you will work.

- Loss of income-producing property for reasons outside of the beneficiary’s control.

- Loss or reduction of pension

- Receiving a settlement payment from a current or former employer due to the employer’s bankruptcy, closure, or reorganization

You may also inquire if you believe incorrect or outdated information was used to determine your IRMAA.

Appealing an IRMAA decision

To make a request, you would submit a Medicare IRMAA Life-Changing Event form or schedule an appointment with your local Social Security office. You will need to supply Social Security with proof of either your correct income or of the life-changing event.

If you do not qualify to request a new initial determination, but you still disagree with Social Security’s IRMAA decision, you have the right to appeal. Appealing an IRMAA decision is also known as a reconsideration.

EXAMPLE

John and Beth Roberts are married and file taxes jointly. Mr. and Mrs. Roberts received a letter informing them of a 2025 IRMAA fee based off of their 2023 income. According to the letter, the income reported for 2023 was $229,000.

Since 2022, John has retired, and their income has decreased to approximately $178,000. John’s retirement is a qualifying event, so the Roberts completed and submitted the IRMAA appeal form, SSA-44. The Social Security Administration confirmed that the Roberts qualify for the elimination of the IRMAA fee. John and Beth Roberts will now pay the standard Medicare Part B and Medicare Part D premiums.

Also, if your IRMAA appeal is approved, you may get a credit or refund on the premiums you overpaid.

IRMAA 2025 Brackets